One of Forrester’s biggest predictions for 2020 should alarm market researchers. According to the research firm, 35% of companies will “go beyond surveys” this new year as brands look for fresh ways of capturing insights.

“More firms will see declining response rates as disappointed customers snub the ubiquitous feedback requests,” predicts Gene Leganza, VP, Research Director, at Forrester. “As the ROI of surveys decreases, the portion of firms that go beyond surveys will increase.”

Given that surveys are a core tool that researchers use to capture quantitative and qualitative data, Forrester’s prediction has massive implications for the industry. Here’s a look at some of the factors behind the predicted decline of surveys and what researchers can do about it.

According to Forrester, a key reason for the survey’s decline is the lack of visibility into how companies actually use the data they get. Fair or not, there’s a perception among consumers that the feedback they’re providing isn’t resulting in meaningful improvement in customer experience.

“Firms drown their customers in survey requests to gain insights into experience quality,” points out Leganza. “Many customers submit themselves to this process, hoping for better experiences. But firms have rewarded these customers poorly: Customer experiences haven’t gotten better for three years.”

“As the ROI of surveys decreases, the portion of firms that go beyond surveys will increase.”

Of course, transforming customer feedback into CX improvements is something that’s not the sole responsibility of market researchers. Becoming insight-driven is a company-wide initiative that needs to come from the top. That said, by amplifying the authentic voice of the customer, researchers are in a good position to influence stakeholders to do something about customer feedback. Storytelling will increasingly become important for market researchers in the 2020s as they look for ways to gain the attention of C-suite executives and inspire action within the organization.

Companies today send out an enormous number of surveys. From the ubiquitous NPS survey to the long, annual employee engagement questionnaire, people are being asked frequently to give their feedback.

Commenting on Forrester’s predictions, MarketingMag Editor Ben Ice says that “customers are losing patience” as they are “buried under the immense weight of requests for feedback and survey participation.” It’s no wonder a massive survey backlash is on the way.

To be fair, we can’t really blame companies for wanting customer feedback. Studies show that insight-driven companies easily outpace their competition, and brands can’t make better decisions without an accurate understanding of consumer attitudes and opinions. Forrester’s prediction should encourage researchers to at least rethink the number of surveys they send out. But as we discuss below, the issue is more than just about the volume of surveys that people receive.

Let’s face it: most surveys are terrible. In fact, I’m willing to bet that many market researchers wouldn’t want to take their own surveys. (Are you?)

Surveys tend to be too long, too formal and…just not very fun. The user experience is clunky. And the language used in most surveys often make them feel like an interrogation rather than a conversation.

Having a suboptimal research experience is not a trivial issue. It not only impacts response rates—it also results to lower-quality—if not outright inaccurate—feedback.

“Most email-based surveys are long, monotonous experiences filled with confusing instructions, a sea of radio buttons, and difficult-to-interpret multi-choice grids,” writes Matt Kleinschmit, CEO and Founder of Reach3 Insights, in a recent ebook.

“This puts people into ‘test-taking mode.’ They feel like they are being ‘studied.’ Faced with the challenge of recalling what they bought or did or saw, let alone the associated whys and hows, they start rationalizing their responses at best. At worst, they simply click random answers as quickly as possible so they can complete the survey.”

Many of us at Rival are research technologists who have spent a lot of time thinking about the future of insight-gathering. We’re convinced it’s time to rethink the traditional approach to how we capture feedback. Our solution to the growing email fatigue problem is what we’re calling conversational surveys—or simply “chats.” A giant leap from traditional online surveys, chats are mobile-first. Everything about chats—the UX design, the distribution channels and the language used—are optimized for the mobile web.

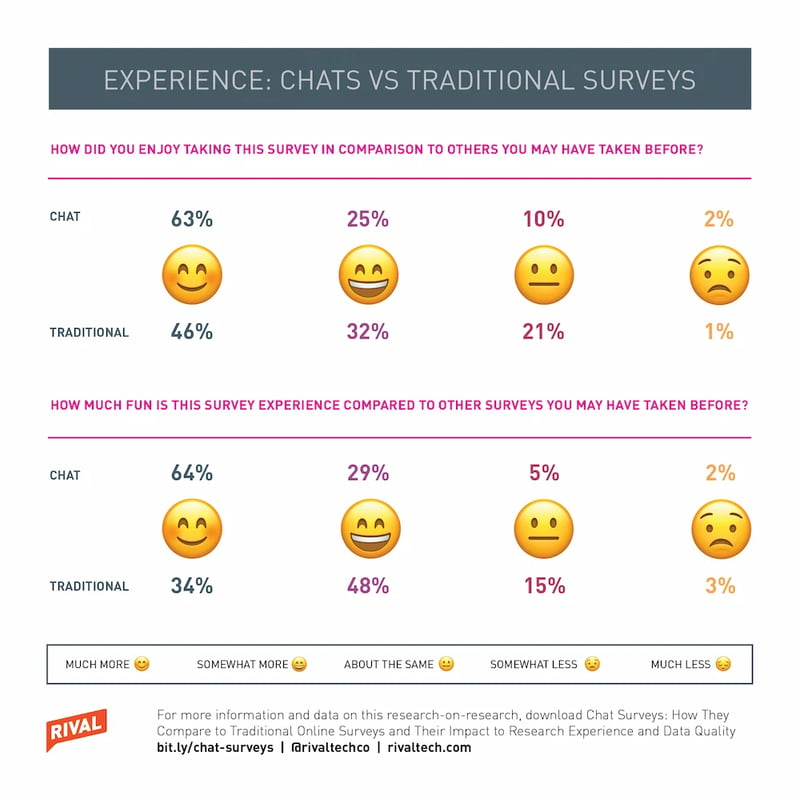

Chats allow you to capture both quantitative and qualitative data, but you’re not boring participants with a long, cumbersome experience. A research-on-research study showed that 93% of research participants felt that chats were more enjoyable than traditional surveys.

Our prediction (or at least our hope 🤞) is that in the 2020s, we’ll see the emergence of more market research software that enable companies to have better, more engaging conversations with consumers.

A small but important detail in Forrester’s prediction is that companies planning on foregoing surveys will not be abandoning insight programs altogether. They will, however, be adapting new technologies and potentially building their own platforms.

“These firms will add data science and analytics skills to their customer experience teams,” writes Leganza. “And they’ll invest in text and speech analytics technologies to mine data from customers’ digital and call-center interactions to understand customer sentiment.”

MarketingMag’s Ice adds, “Tech-enabled customer intelligence will overtake traditional market, customer and product research. This will mainly occur in response to disappointment with results, and the necessity to receive customer insights that enable quick action on behavioral, motivational and values-based trends and preferences in customers.”

Building an insights platform is a massive undertaking, and as Forrester points out, most companies don’t have enough technical expertise to pull it off.

That said, Forrester believes that about half of initiatives to build in-house insight platforms will fail, as “companies realize they don’t have the technical or analytic chops to maintain sophisticated insights systems long-term.”

With the rise of many DIY market research platforms, it’s not surprising many companies are trying to bring insights in-house. But building an insights platform is a massive undertaking, and as Forrester points out, most companies don’t have enough technical expertise to pull it off.

Ultimately, regardless of whether they decide to use existing survey software or build their own platform, companies need to make sure that the resulting experience is significantly better for research participants. If companies fail to provide a more seamless and conversational experience, consumers are unlikely to participate and response rates will continue to plummet.

No Comments Yet

Let us know what you think