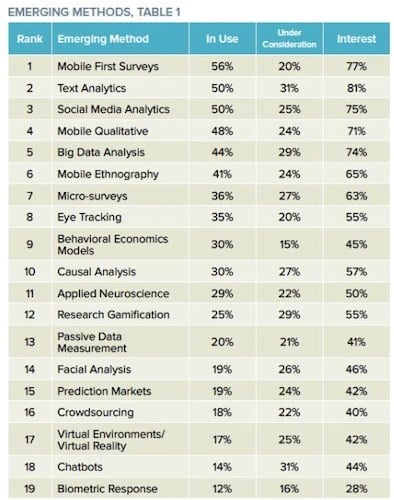

According to the 2020 Insights Practice edition of the GreenBook Research Industry Trends (GRIT) report, mobile-first surveys are finally the most popular emerging research method. The annual study found that 56% of researchers are now using mobile surveys, easily beating text analytics (50%) and social media analytics (50%) as the most widely used emerging market research method today.

The popularity of mobile surveys is pretty broad. For instance, a relatively equal percentage of research buyers (52%) and suppliers (58%) are using this technology. Globally, mobile surveys also enjoy wide adoption, with a majority of researchers in North America (55%), Europe (63%) and APAC (57%) using them.

While it’s encouraging to see that mobile surveys are finally being used by a majority of researchers, GreenBook’s study raises an important question: Is the market research industry adopting mobile-first practices fast enough? 🤔

GreenBook’s survey found that 20% of researchers are considering bringing in mobile survey software into their research toolkit, but 15% are still unsure—and 6% are not interested at all. Other mobile-first methodologies such as mobile ethnography and micro-surveys are growing but aren’t being used by the majority yet.

“It is worrying that 20% of people only list mobile-first surveys as being under consideration,” writes Ray Poynter, Chief Research Officer at Potentiate, in his analysis of GreenBook’s report. “For some time, it has been necessary to accommodate mobile devices for most projects, and it is widely recognized that mobile first is the best way of doing that.”

20% of researchers are considering bringing in mobile survey software into their research toolkit, but 15% are still unsure.

According to recent stats, 5 billion people globally have mobile devices. Many of these people—for instance, younger ones like Gen Zs—are mobile-first consumers or digital natives. If companies want to reach and hear from a more diverse set of customers, their market research strategy should be mobile-first rather than simply being mobile-friendly.

While adapting survey software that supports mobile-first initiatives is important, it’s also not enough if companies want to increase response rates, get richer insights and improve business outcomes. Using mobile surveys doesn’t address the hard reality that surveys in general are falling out of favor with consumers.

The volume of feedback requests people get is resulting to a survey backlash. As MarketingMag Editor Ben Ice recently pointed out, customers are “buried under the immense weight of requests for feedback and survey participation.” From the ubiquitous NPS and CSAT questionnaires to those annoying pop-up website surveys, people are constantly being asked to rate this and that.

Unfortunately, customers don’t see or understand how their feedback is resulting to meaningful improvements.

“Many customers submit themselves to [the survey] process, hoping for better experiences,” points out Gene Leganza, VP at Forrester, in an article about his 2020 predictions. “But firms have rewarded these customers poorly: Customer experiences haven’t gotten better for three years.”

The terrible survey experience is resulting to lower response rates and declining ROI, according to Forrester. The research firm is predicting that more companies will adapt customer intelligence tools and build in-house research platforms this year as a result of the survey backlash.

“If you’ve ever taken an online survey, you know that most look like you’re taking a test."

Unfortunately, re-sizing buttons and open-text boxes so they fit on mobile screens won’t increase consumer appetite for surveys. What’s needed is a complete re-imagining of the survey experience and an examination of the value we’re providing research participants.

Think back to the last time you took an online survey. Was the experience fun and rewarding, or did it seem like a super long interrogation? I’m willing to bet it’s the latter.

“If you’ve ever taken an online survey, you know that most look like you’re taking a test,” Reach3 Insights CEO & Founder Matt Kleinschmit recently explained to MediaPost. “They’re oftentimes very long, there are endless multi-choice grids, radio buttons, and very clinical, formalized language.”

This approach is problematic, according to Kleinschmit, as it results to feedback that’s not as rich or as candid and authentic.

“People get into what I refer to as test-taking mode. They start to think about their answers, they’re rationalizing their responses, they feel like they’re trying to provide the answers that the person who is giving the test wants to hear.”

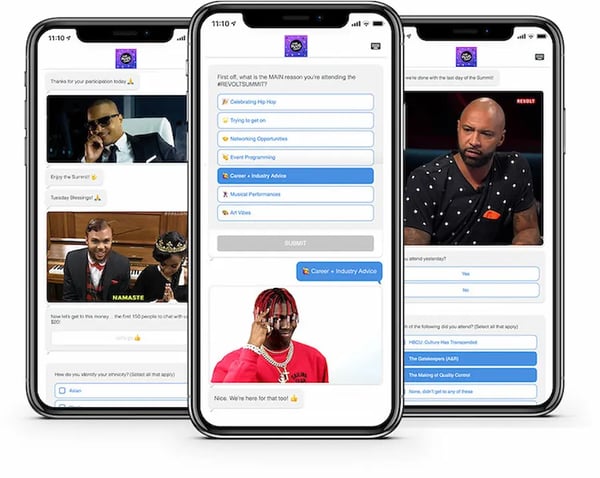

At Rival, we think the survey fatigue issue is so big that we created a new insight platform that—in many ways—is similar to traditional survey tools, but is also significantly different.

We don’t call our surveys “surveys.” We call them chats—conversational surveys hosted through messaging apps like Facebook Messenger, WeChat, WhatsApp or on mobile web browsers. Chat surveys are mobile-first, but they’re not just mobile surveys.

Yes, you can capture both quantitative and qualitative data through chats, but they’re different from mobile surveys in several ways:

Early research-on-research on chats shows that people are responding to chats as a new way of engaging with brands.

Just as important, chats provide the continuity researchers need to be confident with the data they get. In a parallel study we did last year, we saw that chats would generally yield the same business decisions as traditional surveys. Chat survey research also does not introduce any demographic skews if the sample source is the same. That said, given that chats work seamlessly with popular mobile messaging apps and social media, we see a huge potential for this technology to improve in-the-moment research and to reach Gen Zs and more ethnically diverse respondents.

Conclusion

It’s great to see mobile surveys are moving from merely a market research trend into a mainstream, everyday tool for capturing customer insights. As we explored here, however, there’s a bigger opportunity to completely re-imagine surveys and deliver a respondent experience that’s more fun, more conversational and more human.

No Comments Yet

Let us know what you think