In-the-moment research is useful for one very simple reason: human memory is not very reliable.

Market research delivers the most value when it taps into consumers’ authentic, unfiltered thoughts and feelings. And the best way to get genuine feedback is to capture it in the moment – right when an experience is fresh.

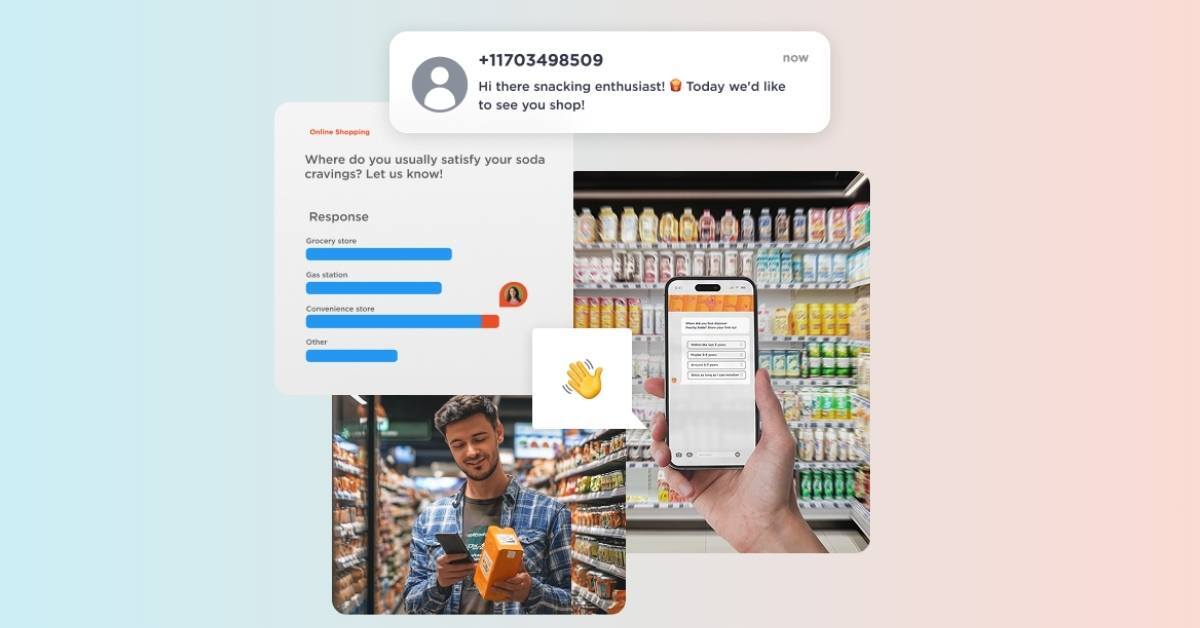

In 2025, this has become easier than ever. Because smartphones are universal, more people are completing surveys via their phone — anywhere between 30% to 94% of participants. This ubiquity of mobile technology – along with conversational research methods and agile insight community platforms – means researchers can gather both quantitative and qualitative feedback in real time, right at the moment it matters most.

In this article, we’ll explore the benefits of in-the-moment research and best practices to make it successful. The first sections are objective best practices and use cases; the final section offers tips on finding the best market research platform for real-time engagement — and why Rival Technologies is worth considering as part of that mix.

In-the-moment research is a modern approach to market research that collects feedback from participants in real time — during or immediately after an experience — rather than through surveys administered long after events.

This real-time technique stands in contrast to traditional research that rely on respondents recalling past experiences, a process prone to memory decay and bias. By capturing feedback on the spot, in-the-moment research yields more authentic, detailed insights and significantly reduces recall bias, since participants share their thoughts while details are still fresh. It often leverages mobile tools (e.g., SMS or WhatsApp) to reach participants instantly in their natural context, enabling timely, context-rich data collection that traditional methods cannot match

One of the biggest challenges in traditional survey research is recall bias. When you ask people to remember events or feelings after the fact, details get lost or distorted.

Human memory is notoriously unreliable — most of us struggle to recall what we did yesterday, let alone weeks ago. As a result, retrospective surveys often prompt respondents to rationalize answers or misremember details, compromising the authenticity of the feedback.

Capturing insights in the moment is a powerful antidote to this problem. By minimizing the lag between an experience and the feedback about it, you can collect insights that are more accurate and specific. Neuroscience research in recent years has tried to bypass recall by measuring implicit, fast “System 1” reactions, but even those advances don’t fully replace simply talking to customers directly about what they think and feel. In many cases, you still need to ask people directly — and the closer you can get to the actual moment of the experience, the clearer their answers will be.

Real-time research lets you capture what consumers truly think, feel or do, instead of what they think they remember.

By engaging consumers in the moment, researchers can drastically reduce recall bias and obtain the authentic, in-the-moment reactions that drive better decision-making. In short, real-time research lets you capture what consumers truly think, feel or do, instead of what they think they remember.

In-the-moment research isn’t just about timing – it brings a host of benefits that improve data quality and research outcomes. Some key advantages include:

Higher accuracy and detail: When feedback is given during or immediately after an experience, the details are still fresh. People can recall specific moments, emotions, and pain points more vividly. The closer you get to the experience, the more precise and useful the insights will be.

Richer context and qualitative depth: Mobile in-the-moment surveys let participants share photos, videos, or open-ended comments on the spot, adding context that would be missed in a delayed survey. Research has shown that a conversational, chat-based mobile survey can produce open-ended responses up to 8 times longer than those in traditional online surveys, especially when enriched with AI probes or video responses. These richer responses capture nuances, emotions, and context that drive deeper understanding.

Improved participant experience: Reaching out to people in real time (such as during an event or right after a purchase) makes respondents feel heard and valued. They often enjoy sharing input when it’s timely and relevant to what they’re doing.

In fact, participants engaged in moment often feel like “special insiders” who can influence the brand by giving input at just the right time. This positive experience can boost response rates – people are more willing to answer a few quick questions about something happening now versus filling out a long survey later. Real-time participation is more natural and less mentally taxing, since respondents don’t have to rack their brains for forgotten details.

Faster insights mean faster decisions and a competitive edge in reacting to market preferences.

Speed and agility: In-the-moment research delivers insights faster, enabling teams to be more agile. You don’t have to wait weeks to compile feedback – responses roll in immediately, often in real time. This speed means you can iterate and react quickly. For instance, imagine getting product feedback within hours of release, or gauging audience reaction to a live TV show during the broadcast. In practice, it’s been shown that a well-designed mobile survey can get a large portion of its responses shortly after launch – up to 40% of replies in the first hour on some top market research platforms. Faster insights mean faster decisions and a competitive edge in reacting to market preferences.

In short, by eliminating the usual lag between an event and the feedback about it, in-the-moment research addresses many challenges of recall-based studies. You get better data, more engaged respondents, and quicker results — a win-win for both researchers and participants.

A common misconception is that in-the-moment research only applies to live events. In reality, real-time feedback can enhance many types of research projects. Anytime you want to understand an experience as it unfolds (or immediately after), in-the-moment techniques are valuable.

Here are a few of the most common use cases:

Capturing feedback during live experiences yields highly accurate reads on satisfaction. Whether it’s a sporting event, a music festival, or a trade show, you can send attendees a brief mobile survey while they’re at the venue or just as they leave. This helps measure exactly what people liked or disliked, and it’s great for evaluating event logistics, content, or the ROI of sponsorships and brand activations. Because responses are immediate, you avoid the fog of memory – attendees can tell you in real time if the lineup, venue, or promotions hit the mark.

This approach works well for companies like Coca-Cola that use Brand Experience Predictor. They engage participants before, during and after brand activations, using Rival’s recontact feature to continue the conversation.

Real-time research is equally powerful for entertainment and media. For example, TV networks and streaming platforms use in-the-moment polls and chats to get viewer feedback during a live show or broadcast. (Our sister company, Reach3 Insights, created a solution called Watch Party for this.)

You might ask viewers to rate a new episode right after it airs, or get their opinions on commercials and storylines as they unfold. This instant feedback helps content creators and advertisers gauge audience reactions beyond traditional ratings. In today’s multi-screen world, viewers can respond on their phones while watching the show.

The result is a rich understanding of engagement that can inform programming decisions, ad placements, and more – essentially providing feedback at the same time as ratings or other performance metrics.

In-the-moment research is incredibly useful along the shopper journey. Brands can send consumers on mission-based “shop-alongs” or prompt them to give input as they shop in a store or browse online.

For instance, a retailer might text a few questions to a customer right after they check out, asking about their experience finding products or satisfaction with the service. Or a CPG company could have users scan a QR code on a product package to take a quick in-the-moment survey when they first try the product at home.

By engaging people at the point of purchase or first use, you can uncover insights about product placement, packaging, or usage that would be forgotten later. These transactional and in-situ insights are invaluable for understanding the path-to-purchase and the factors influencing decisions while they’re actually occurring.

These examples just scratch the surface. In-the-moment approaches have also been used for things like mobile diary studies (having participants log experiences in real time over a period) and in-home product trials (collecting feedback during usage).

The key thread across all use cases is timing: you’re reaching people at the moment of truth, when their experiences are unfolding, to get feedback that is immediate, accurate, and candid.

Executing in-the-moment research requires a slightly different approach than traditional surveys. Participants are often on the go, using their phones, and not willing to spend a lot of time. Below are some best practices to ensure you get the most out of real-time mobile feedback:

When someone is in the middle of an experience (or just finished one), they won’t tolerate a 20-minute questionnaire. Keep your conversational surveys brief and focused – just a few pertinent questions that can be answered in a few minutes. Long surveys are a big no-no for in-the-moment research. Respect your participants’ time by zeroing in on key questions while the experience is fresh.

Optimize everything for mobile devices, from the survey layout to the question formats. It’s not enough to simply be mobile-friendly; the whole experience should feel native on a smartphone.

Use easy-to-tap answer options (avoid large grids or tiny checkboxes), and make sure your language is concise. A clean, responsive design prevents frustration and drop-offs. Given that most respondents will be on their phones, always consider how the survey looks and flows on a small screen. Test it on a phone beforehand.

People are used to messaging apps and chats, so mirroring that style can increase engagement. Try to frame questions like a friendly conversation rather than a formal interrogation.

Some modern survey platforms let you create chat-style or conversational surveys that feel like texting back and forth. This tone can put respondents at ease and encourage more open, honest answers. In fact, research-on-research has found that well-designed conversational surveys provide a better respondent experience than traditional Q&A forms, with no loss in data quality.

Making your surveys engaging and easy to complete is worth it and has benefits beyond engagement.

“Fun may sound like a lighthearted concept, but it deserves a place in serious research design,” Jennifer Reid, Co-CEO and Chief Methodologist at Rival Group, writes in her article for Research-Live. “It is a metric that translates directly into better attention, heightened thoughtfulness and increased data quality.”

To get quick feedback, reach people through the channels they already use. SMS text surveys are a popular choice for in-the-moment research – they consistently earn high response rates, far outperforming email surveys. Messaging apps like WhatsApp or in-app notifications can also be effective for certain audiences.

The idea is to send your questions via a channel that will ping the user immediately on their phone. For instance, an SMS or WhatsApp message with a survey link can prompt instant engagement. Because people have their phones on them 24/7, an SMS-based, mobile messaging approach is perfect for in-the-moment research.

For best results, make sure any links or interfaces you send are quick to load and don’t require cumbersome logins.

A picture is worth a thousand words – and a video even more. If it suits your research, allow respondents to snap a photo or record a short video as part of their feedback.

Modern customer insights platforms today make it easy for participants to upload a photo or video clip on the fly. This can be invaluable for context: e.g. a shopper might send a photo of a store display they found confusing, or an attendee at a concert might share a quick video showing the crowd’s reaction. These visual and audio inputs add color to the data and help bring the consumer’s perspective to life. They can also provide great assets to improve data-driven storytelling. Always ensure it’s optional and easy to do, and provide clear instructions for those who want to share media.

The when and how of your engagement are critical. If you’re surveying during an experience (like at an event), consider sending questions during natural breaks or right after a noteworthy moment, so you’re not interrupting too much.

If it’s post-experience, strike while the iron is hot – for example, send the survey immediately or within minutes after the transaction or event. Studies show that you’ll get more responses and better data if you don’t wait too long. In essence, faster outreach yields better participation and more authentic detail.

Also be mindful of time zones and local hours (the best market research platforms will let you schedule or target by time zone). The goal is to engage at a moment that makes sense for the participant.

By following these best practices – short and sweet surveys, mobile-first design, conversational tone, convenient channels, rich media, and smart timing – you can significantly improve the success of your in-the-moment research. Not only will you gather higher quality data, but your participants will appreciate the brevity and relevance, keeping them more engaged for future research invitations.

To execute in-the-moment research effectively, having the right market research tool is crucial. You’ll need a solution that can reach people instantly on mobile, capture rich data, and deliver results fast.

Here are a few things to look for when evaluating an in-the-moment market research platform:

Mobile-first and multi-modal capabilities: The platform should be designed for mobile engagement at its core. This means it can deliver surveys via text message, mobile apps, or messaging services like WhatsApp, and the survey interface is optimized for small screens. It should support both quantitative questions and qualitative feedback (like open-ends, photo/video uploads) in one seamless experience.

The right mobile survey platform makes it easy for participants to transition from a multiple-choice question to, say, recording a 30-second video, all on their phone.

Speed and real-time analytics: Look for tools that enable real-time data collection and reporting. When responses start pouring in within minutes, you want a dashboard that updates instantly and analytics features (like text analysis or charts) that can keep up. This real-time visibility allows your team to monitor feedback as it comes and even act on insights faster. Some modern platforms even use AI tools to summarize open-ended feedback on the fly, helping you glean insights from qualitative data in real time.

Conversational and engaging UX: As discussed, a chat-style or conversational survey experience can drive better engagement. Platforms that offer a conversational research approach – for example, presenting questions as if in a chat dialog, with friendly micro-copy and even emojis or GIFs when appropriate – can make surveys feel more like an interactive conversation than a boring form.

This is especially important for in-the-moment research, because a fun, intuitive UX will keep people interacting when they’re in the middle of other activities. Ensure the platform lets you customize the tone and design to fit a conversational style (and your brand voice).

Panel or community integration: Speed matters in reaching the right audience. If you have an existing insight community or market research online community, the platform should integrate with it so you can quickly deploy in-the-moment studies to those members. Even if you don’t have a standing community, the platform should have robust sampling options (or integrations with panel providers) to find and contact participants at a moment’s notice.

The ability to target specific segments (by location, behavior, etc.) and send push notifications or SMS invites to them instantly is a huge plus. This ensures you can grab the feedback exactly from whom and when you need it.

Rival’s conversational research platform is purpose-built for mobile, real-time engagement – offering SMS and chat-based surveys that make it simple to reach people on their phones. The Rival platform emphasizes a conversational, chat-like experience (called “chats”) that yields high engagement and rich data.

In fact, our research shows that mobile messaging approach often gets up to 40% of survey responses within the first hour of deployment. A mobile-first approach means participants can easily respond with photos or videos directly from their device, adding valuable context to quantitative answers.

Rival seamlessly blends quant + qual + unlimited video — you might ask a multiple-choice question, then follow up with an open-ended probe or video prompt, all in the same mobile chat interface.

Rival Technologies is also known as a top insight community platform. This means they understand how to recruit participants, keep respondents engaged over time, and sustain high response rates. This approach has been shown to deliver higher response rates, deeper engagement, and faster time-to-insights compared to traditional research tools. For organizations looking to modernize their research, a platform like Rival is worth including on the shortlist.

In summary, in-the-moment research has become an essential tool in 2025 for capturing authentic consumer insights. By overcoming recall bias and embracing mobile, conversational methods, companies can hear the voice of the customer in real time and act on it with agility. Whether you’re gathering feedback at an event, during a live digital experience, or at the point of purchase, following best practices will ensure your real-time research is both effective and respectful of participants.

And with the right platform enabling mobile engagement and rich, fast data collection, you can truly bring the consumer’s voice into the moment of your decision-making.

If you’re interested in implementing in-the-moment research or upgrading your insight capabilities, we invite you to reach out to our team at Rival Technologies. We can help you explore how a conversational, mobile-first approach to agile research can elevate your insights program.

Subscribe to our blog to receive the latest news, trends and best practices from market research experts.

No Comments Yet

Let us know what you think