The best research doesn’t come from strangers—it comes from people who know and care about your brand. After three decades of experience building insight communities, I’ve seen branded insight communities foster powerful, ongoing conversation between businesses and their most engaged customers. Real engagement, real depth, and real insight come from people who have a clear understanding of who they are talking to.

As you can imagine, I field a lot of questions about the best way to uncover the best insights in my role as Co-CEO and Chief Methodologist at Rival Group. What I can tell you for certain is that consumer behavior is evolving, data reliability is under the microscope, and businesses continue to face pressure to make smart decisions quickly. Insight communities play a key role in ensuring the delivery of clear, quality insights, all while keeping pace with change.

Branded insight communities are research platforms where participants know the company conducting the research. These communities are created and managed by brands to gather ongoing feedback from their most important audiences. That could include customers, viewers, members, subscribers fans, prospects, and everything in between.

Research teams from a wide range of industries—including media, apparel, sports entertainment, hospitality, tech, telco and consumer goods—use branded communities. Many use cases for insight communities can be conducted using this tool. Many CMOs love branded communities because they provide a direct line to hear the authentic voice of the customer.

Blind communities, on the other hand, operate without revealing the sponsoring company. While there are some research uses cases where an unbranded insight community may make sense, we’ve seen that branded ones usually yield the research and business results you're looking for.

Branded communities provide a direct, ongoing connection with engaged consumers who care about your brand and want to be part of its evolution. Here’s how:

Engagement is the top benefit of a branded insight community. Just knowing who you’re talking to changes how you respond, so participants feel more connected and invested—not just feeding you praise and positivity.

Rather than just answering questions, they become active contributors to the research process. We’ve seen response rates in branded research communities go well above and beyond those of traditional surveys or blinded research panels. Members provide deeper, more thoughtful feedback because they see the value in their participation—it’s not just about filling out a survey, but about helping shape the future of a brand they care about.

One of the biggest advantages of branded communities is the ability to build lasting relationships with respondents, improving data quality over time.

One of my favorite examples of this is a research community we’ve been running for a snack brand for almost five years. Their response rates are in the 80% range, and they even send their community members products to test. These IHUT (In-Home Product Testing) initiatives are made much more efficient with a dependable and consistent response rate.

The quality of feedback gets better as time goes on because community members actually understand what the company needs. And because they really care about helping the brand, they can be trusted to be more critical and detailed in their responses than just some person off the street who doesn’t know where a survey conversation is going.

With branded communities, we have a situation that I like to call the “virtuous circle of research.” You recruit people with full transparency into the branded community, they care about your brand, they give you better results, and you make better decisions.

The cost of research is lower because companies don’t have to continuously recruit new participants—engaged members stay active.

To bring it full circle, you in turn tell them what you learned or how you made decisions based on what they have shared, and they feel more engaged in the circle. Additionally, the cost of research is lower because companies don’t have to continuously recruit new participants—engaged members stay active, providing a stable and reliable research base.

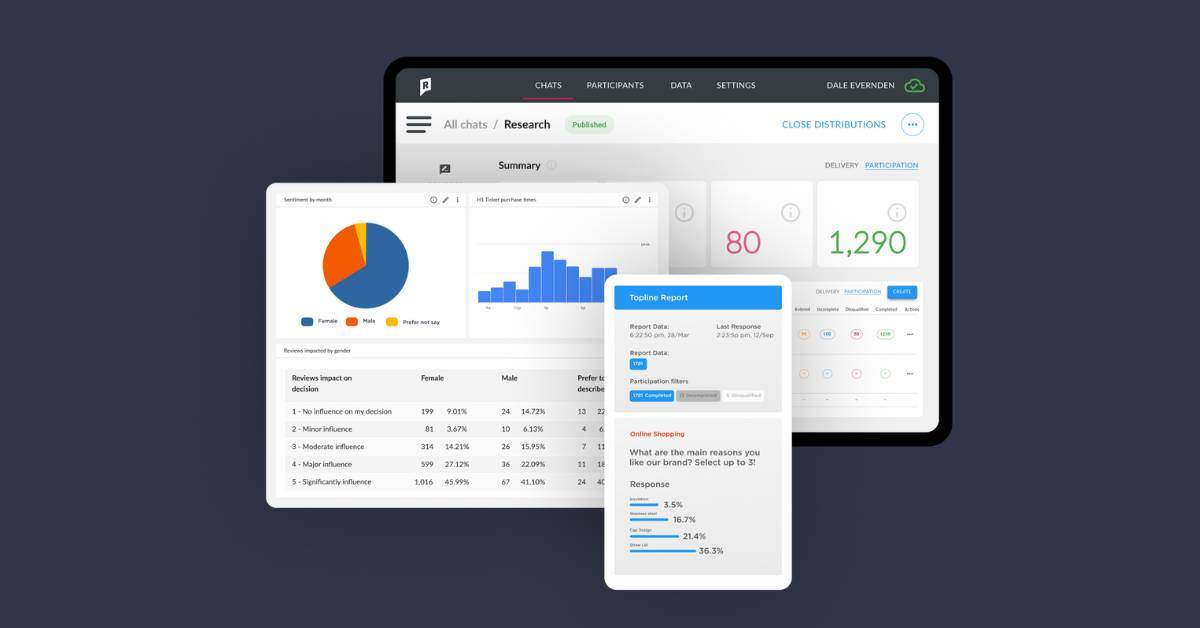

At Rival, we take this a step further with our conversational approach to research and applying insight community best practices, so participants are truly engaging in a two-way conversation with the brand.

The notion that branded communities are composed only of fans, and fans are only going to give you positive ratings and feedback has been disproven over and over again. In fact, these people tend to be a little bit tougher and more discerning with their feedback because they feel they have a vested interest in the brand’s success.

The assumption that branded communities produce only favorable feedback ignores the reality of how engaged participants behave.

Bias is a concern in all research methodologies, but the assumption that branded communities produce only favorable feedback ignores the reality of how engaged participants behave. These members aren’t just passive survey-takers—they are invested contributors who want their voices to be heard. Over time, long-term community members become even more critical and thoughtful, not less. Instead of producing shallow responses, branded communities create an ongoing dialogue that leads to richer insights and stronger strategic decisions.

Branded communities may be the best choice for most research needs, but blind insight communities have an important role in certain scenarios. For brands looking to gauge broad market perception, measure brand awareness, or track competitive insights, blinded research is often the best approach. It allows for unbiased feedback in areavis such as:

That said, before defaulting to a blind research community, it’s important to consider the trade-offs. Blind communities require ongoing investment in recruitment and management, and engagement tends to decline over time. Additionally:

Finding a sufficient number of participants for small target groups can also be difficult. When taken all together, these challenges can raise the overall cost of using a blinded community significantly.

If your brand is looking to reach beyond your usual crowd but don't want the headache of managing a blinded community, I recommend a solution like Voice of Market.

Instead of struggling with a panel that constantly needs recruiting and upkeep, Voice of Market connects you with trusted sample providers who bring in fresh, engaged participants every time. And because Rival’s platform is built for mobile-first, conversational research, the whole experience feels more like a real chat than another boring survey—so people actually want to participate.

Voice of Market connects you with trusted sample providers who bring in fresh, engaged participants every time.

This approach lets you tap into a broader, more diverse audience—including non-customers and even people shopping with your competitors—without the hassle of maintaining a panel. You get the flexibility to run quick, agile studies while still getting the deep engagement that makes the Rival market research platform so powerful.

In a world where trust in data quality is crumbling, making real connections is the only way forward. And it’s hard to do that from behind a mask.

The best insights don’t come from anonymous surveys—they come from real conversations.

A branded community, when ran in the right insight community platform, can take your research out of the black hole of one-off surveys and into an ongoing conversation. When people know who they’re talking to, they engage more, share deeper insights, and feel like their feedback actually matters.

At the end of the day, the best insights don’t come from anonymous surveys—they come from real conversations. Brands that embrace transparency and dialogue will get better data, make smarter decisions, and build lasting relationships with the people who matter most.

If you're weighing the benefits of an insights community, our team is here to help. We’re happy to walk you through the pros and cons in the context of your business needs. This is a topic I can talk about all day, so don’t hesitate to reach out!

Subscribe to our blog to receive the latest news, trends and best practices from market research experts.

No Comments Yet

Let us know what you think