The COVID-19 pandemic is highlighting the importance of having a research community of customers you can tap into for ongoing insights. As all of us are experiencing firsthand, social distancing is resulting in profound and frequent changes in people’s moods, behaviors and attitudes. During this time of unprecedented uncertainty, the ability to reach your own online insight community ready to provide feedback is crucial to making agile, data-driven business decisions.

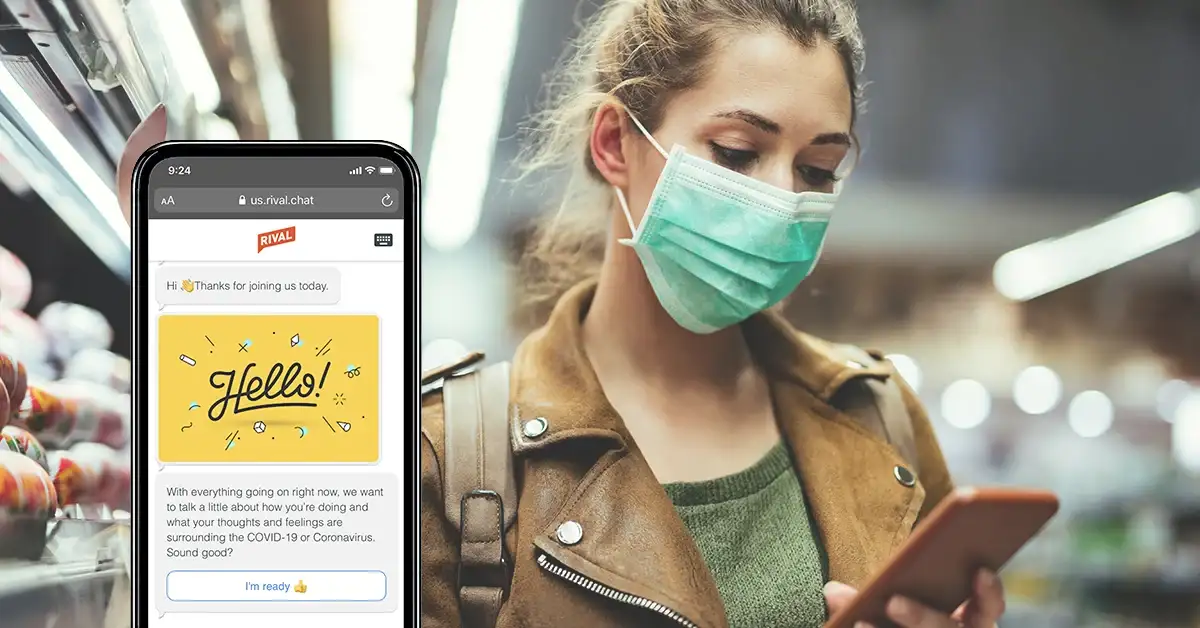

That’s why when the pandemic escalated earlier this year, we quickly mobilized to use our own market research platform to create a community of American and Canadian consumers. Titled Consumer Closeness in the Age of Social Distancing, this complimentary research program from Rival Technologies, Reach3 Insights and Angus Reid Forum aimed to help senior marketers and researchers get an accurate understanding of the underlying motivations driving changes in customer behaviors.

Doing research amid the COVID-19 crisis has made it apparent that quality insights and good respondent experience are two sides of the same coin.

As the Chief Methodologist and President at Rival Technologies, my mission is to help our customers conduct research in a way that both drives business outcomes and prioritizes the experience of research participants. The Consumer Closeness program has only solidified my commitment to this personal mission. Doing research amid the COVID-19 crisis has made it apparent that quality insights and good respondent experience are two sides of the same coin.

Through this program, we’re continuing to uncover new market research best practices for the mobile messaging era. Through conversational research design, dynamic sharebacks, and video feedback and photos, we can re-imagine community-based research to consistently get richer, deeper insights from mobile-first consumers.

It took us just a few days to build our community. To recruit, we used conversational surveys and tapped into a mix of traditional and next-gen (e.g. social sampling) recruitment sources to invite people to participate. At the end of this recruitment survey, we invited people to subscribe to future engagements.

To encourage respondents to sign up, we made it clear what future chats will be about, why people should subscribe, and how often we’ll be reaching out.

We saw an incredible re-contact rate, enabling us to build an insight community with a large-enough sample size in a short amount of time. I attribute this to the fact that we made everything about the recruitment survey engaging for the respondents. We also set the expectations upfront. To encourage respondents to sign up, we made it clear what future chats will be about, why people should subscribe, and how often we’ll be reaching out. People who subscribed became part of our research community.

Of course, once the community was recruited, we had to make sure we kept people engaged. We created a research roadmap that outlined weekly activities with a mix of more serious engagements and more light-hearted sharebacks. By engaging our community regularly, we’ve been able to maximize community engagement while capturing valuable insights we can share with Rival customers.

.webp?width=300&name=covid-19-survey-consumer-sentiment%20(1).webp) One of our biggest beliefs at Rival is that market research needs to be conversational. Research should not feel clinical and impersonal. Research should feel like a conversation with a friend or family remember rather than an interrogation from a faceless brand.

One of our biggest beliefs at Rival is that market research needs to be conversational. Research should not feel clinical and impersonal. Research should feel like a conversation with a friend or family remember rather than an interrogation from a faceless brand.

This need to be conversational is even more critical during a crisis. When so many people are facing fear and uncertainty, a cold and very transactional survey will turn people off.

From the onset, we kept the tone and the language friendly and empathetic. This meant thinking about how we would talk about topics with own friends or family members. A discussion about how people keeping busy was made light-hearted with a reference to homemade bread (everyone's doing it!), while a panel survey about finances (a tricky topic) acknowledged from the beginning that for many, this is a difficult time.

One interesting technique we used consistently throughout this study was to begin our conversational surveys with the same question: how are you doing today? Asking this question allowed us to track people’s mood over time, as you can see from the infographics below.

.webp?width=599&name=Rival%20tech%20-%20Changes%20in%20Amercian%20Mood%20(1).webp)

![]()

Beginning a survey or a chat with “how are you doing today” is, admittedly, not considered by many as a market research practice. But this tactic makes sense if you re-frame the activity as a conversation. In real conversations with friends and family, it’s not weird to begin by asking them how they are doing. Our research participants didn’t think it was a weird question—because it’s something they would naturally ask someone else.

A major benefit of having an online research community is that you can track metrics that matter to your business and see changes over time. In this specific program, we were tracking changes to consumer sentiment, but a company might choose to track something like brand awareness or purchase intent.

During a time of crisis, it’s important to act with customer empathy and agility.

Of course, it’s important to be prescriptive when reporting this data and to do something about it. For our Consumer Closeness program, for example, the week-by-week changes to people’s moods provide useful input when planning marketing programs and messaging during the COVID-19 pandemic.

From weeks 1 to 3, stress and anxiety were quite high, and so social media updates that were too cheery would have been very inappropriate. Looking at the later weeks, we see that people’s moods were starting to shift significantly towards boredom. This suggests a potential opportunity to connect with consumers by building campaigns that would help people fill their time. (One interesting real-world example comes from McDonald’s and Heinz.) This strategy would have been inappropriate a few weeks ago, but with shifting consumer moods, it could resonate with a lot of people.

During a time of crisis, it’s important to act with customer empathy and agility. Having a research community of customers can provide senior leaders and marketers the necessary real-time insights to navigate uncertainty. That said, you have to make sure that community members find the experience valuable and enjoyable.

There’s more to unpack here, and over the next few weeks, I’ll be sharing more best practices on how to conduct market research in the age of social distancing. If you’d like to receive updates, please sign up through the Rival Technologies blog.

Subscribe to our blog to receive he latest news, trends and best practices from market research experts.

No Comments Yet

Let us know what you think